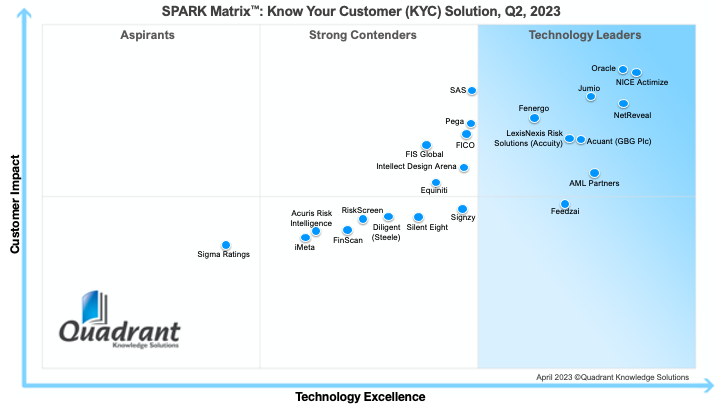

Global advisory and consulting firm Quadrant Knowledge Solutions positioned NICE Actimize as a top performing Know Your Customer/Customer Due Diligence (KYC/CDD) Technology Leader in its recently released “SPARK Matrix™: Know Your Customer (KYC) Solution, 2023” report.

The Quadrant Knowledge Solutions SPARK Matrix provides competitive analysis and a ranking of the leading KYC vendors. For the third consecutive year, NICE Actimize’s consolidated KYC/CDD solutions scored the highest across the performance parameters of technology excellence. A key differentiator was that NICE Actimize’s CDD-X provides complete customer life cycle risk coverage, including onboarding, ongoing due diligence, and enhanced due diligence (EDD) processes.

According to Quadrant Knowledge Solutions “primary differentiators include entity-centric risk profiling and scoring that is aligned with Actimize’s Entity-Centric AML Strategy. NICE Actimize offers a holistic view of entity risk by integrating customer risk with transaction and screening risk. It further continuously monitors any high-risk changes in customer transactional or screening risk, including utilizing investigation disposition decisions to reassess the customer risk score.”

The Quadrant Knowledge Solutions SPARK Matrix provides competitive analysis and a ranking of the leading KYC vendors. For the third consecutive year, NICE Actimize’s consolidated KYC/CDD solutions scored the highest across the performance parameters of technology excellence. A key differentiator was that NICE Actimize’s CDD-X provides complete customer life cycle risk coverage, including onboarding, ongoing due diligence, and enhanced due diligence (EDD) processes.

According to Quadrant Knowledge Solutions “primary differentiators include entity-centric risk profiling and scoring that is aligned with Actimize’s Entity-Centric AML Strategy. NICE Actimize offers a holistic view of entity risk by integrating customer risk with transaction and screening risk. It further continuously monitors any high-risk changes in customer transactional or screening risk, including utilizing investigation disposition decisions to reassess the customer risk score.”

Get in Touch

Get in Touch