Thanks to the digital acceleration brought on by the pandemic era, financial criminals are constantly adapting and evolving their tactics to get ahead of financial institutions (FIs). Keeping pace with these criminals is a challenge in of itself, and when you couple that with the need to comply to ever-changing regulations? FIs are finding that all of their time and resources are dedicated to these initiatives, instead of allocating it to elevating the customer experience to compete.

Fighting financial criminals requires making faster and smarter decisions to keep up.

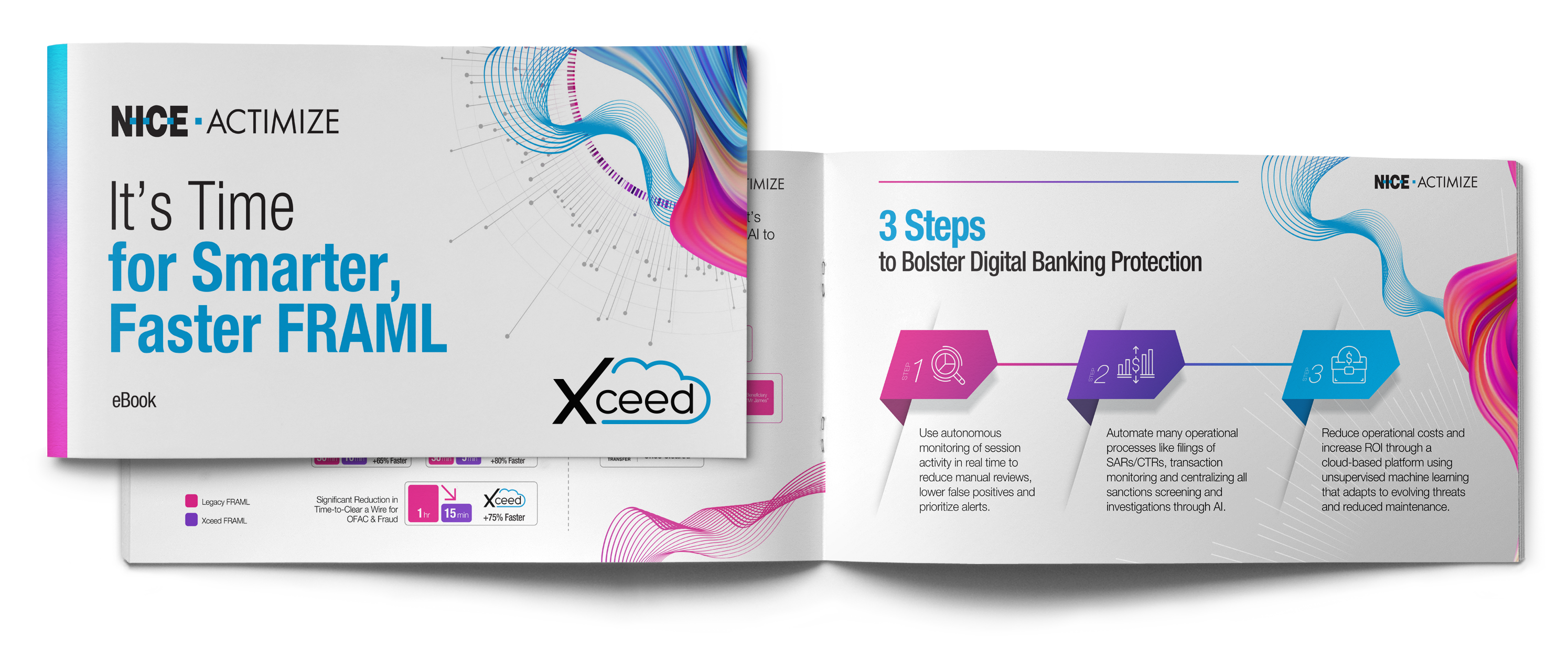

In this eBook, you’ll learn how NICE Actimize Xceed’s cloud-based, AI-first approach to fraud prevention and AML can help mid-market, regional and community banks, and credit unions:

- Reduce manual reviews, lower false positives and prioritize alerts

- Automate many operational processes like filings of SARs/CTRs, transaction monitoring and centralizing all sanctions screening and investigations

- Reduce operational costs and increase ROI

Download this eBook now to get the full picture!