With the increasing emphasis on sanctions monitoring in today’s global regulatory climate, financial institutions using legacy watchlist monitoring solutions may not be able to keep up with demanding requirements. Addressing this focus on sanctions, and delivering precision in matching and detection requirement, NICE Actimize's AI-powered screening solution accurately identifies risk, ensuring compliance.

Serving as the foundation for data-driven, advanced screening and monitoring processes, NICE Actimize’s WL-X screening solution expedites customer onboarding while reducing friction.The advanced solution also offers best-in-class detection featuring advanced facial biometrics, intelligent payment parsing in compliance with ISO20022, and advanced culture/name matching technology. NICE Actimize also achieved best-in-class scores for data methodology, as well as in reporting and audit trail capabilities.

This report focuses on three areas of the financial crime solutions market:

1. Name screening. Screening individuals against sanctions and politically exposed persons (PEP) lists.

2. Transaction screening/filtering. Screening transactions against sanctions and other lists.

3. Transaction monitoring. Reviewing transactions to identify suspicious activity.

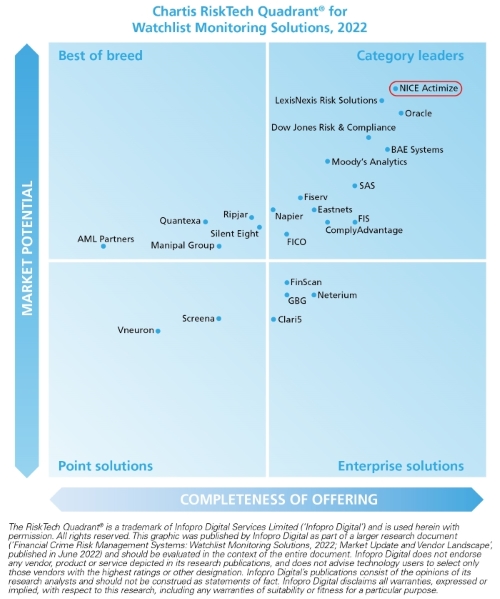

Download your complimentary copy of the report to learn more about key trends in the market and the vendor landscape for Watchlist Monitoring Solutions.