As Financial Services Organizations developed their fraud management strategy for 2020, anticipating a global pandemic was not in the plan.

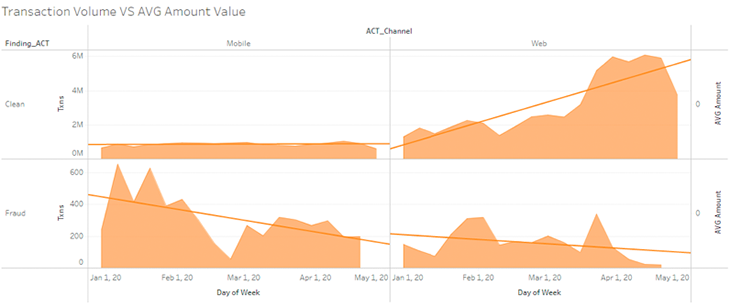

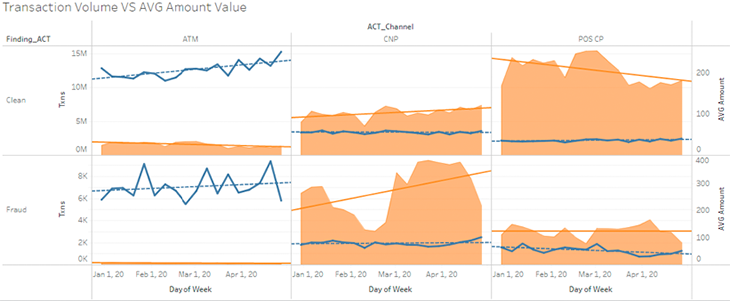

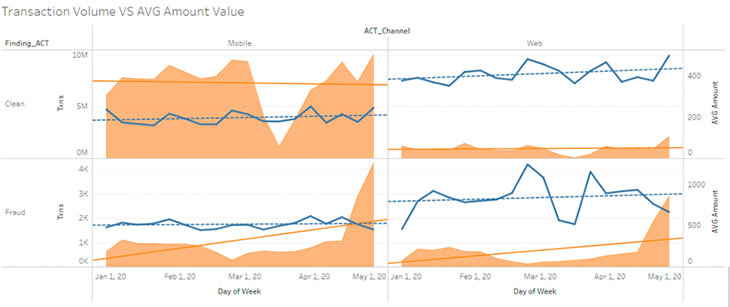

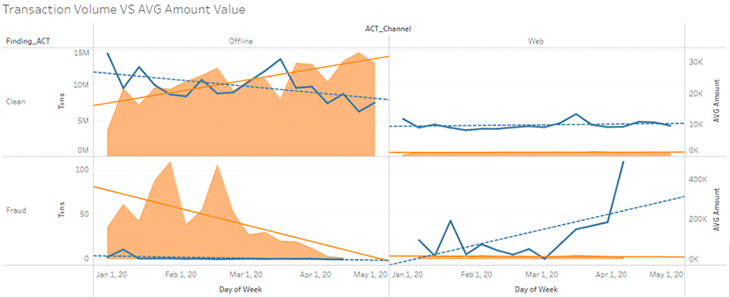

Recently, FSOs have had to quickly adapt their fraud controls to account for the changes in both genuine customer and fraudster behavior. In addition, the fast move to payments digitization brings more web and mobile banking registrations and increased use of P2P services – which in turn attracts related fraud scams.

As society adjusts to our new normal, many of these changes are likely to remain. FSOs must stay nimble to proactively monitor the shifting fraud threat landscape. With ever-changing malware, new methods of cross-channel account takeover and social engineering, fraudsters constantly test the limits of FSOs’ fraud protection strategies, and then meticulously plot their next attack method accordingly.

NICE Actimize is offering an exclusive look at our fraud insights around COVID-19. Until now, these insights were only available to our ActimizeWatch managed analytics service clients.

Fill out the form to access more data trends and expert insights