On-Demand Webinar

On-Demand Webinar

OVERVIEW

From geopolitical tensions and sanctions evasion to crypto assets and digital disruption, financial crime continues to evolve rapidly. New and emerging risks are ever-present, and a danger to all financial services.

Bad actors who profited during the pandemic continue to identify new opportunities to exploit geopolitical tensions, the global economic downturn, increased digitalisation in financial services, and outdated AML systems.

Compliance teams have been forced to adjust to another, new, “new normal”, leveraging graph analytics tools, supervised and unsupervised models, and other techniques to keep pace with quickly evolving criminal behaviours.

In this webinar, Regulation Asia and NICE Actimize unveil the findings of our second annual study, the AML Tech Barometer, which explored emerging financial crime priorities for financial institutions based on input from around 200 practitioners in APAC.

KEY THEMES

- AML Pain Points: In 2023, what do firms expect to be the most notable challenges for their AML programmes?

- Technology Investment: In 2023, what systems, technology, tools and data sources are FIs planning for AML?

- Regional trends: How do financial crime typologies, regulatory approaches, and attitudes to AML vary around the APAC region?

- Industry trends: What are the impacts of geopolitical and economic tensions and how are these factors driving change?

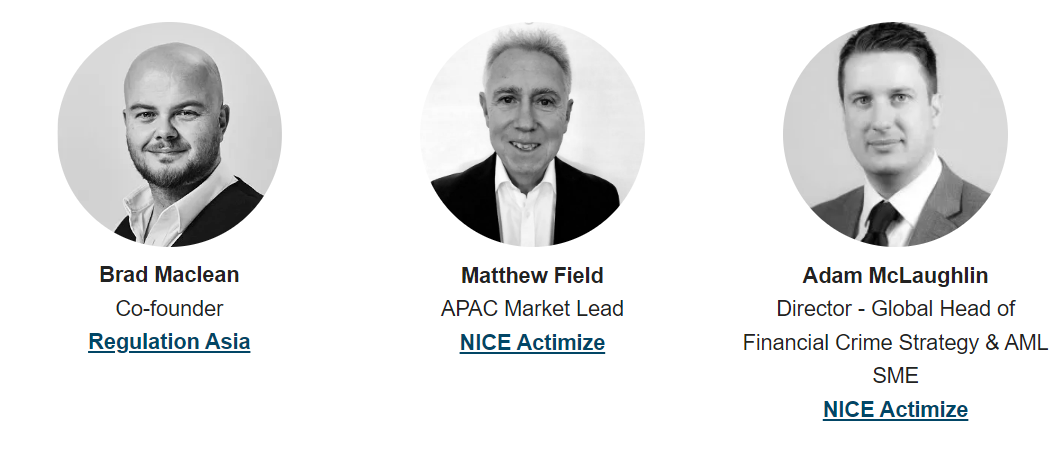

SPEAKERS